Motivating and inspiring employees can be done in many different ways. But one strategy that is growing in popularity is the use of phantom shares. Also known as virtual stock options, phantom shares promise to deliver the same economic benefits as stock options without granting any actual stock. If you're ready to learn more about phantom shares, keep reading to discover how they work and how they can impact your startup!

What are Phantom Shares?

Phantom shares, also known as phantom stock or virtual stock options, are a popular industry trend among startups. Such a compensation asset aims to reward, keep and inspire employees. Here is how they work:

- Those who get phantom shares do not own a stake in the company. Unlike stock options, recipients of phantom shares do not get a right to buy shares or become shareholders.

- Instead, the idea is to link the value of phantom shares to the actual value of the company's stock. So the compensation from phantom shares is tied to the company’s stock value.

- Phantom shares provide the team with the opportunity to benefit from company growth. It means that when a company's share value increases, the potential compensation also goes up.

- Unlike equity compensation, there's no requirement for startups to set aside actual shares as assets when implementing a phantom stock plan.

- Phantom shares usually get liquid when the company gets acquired or goes public or if the company decides to do a buyback.

- Any gains from the assets must be reported to tax authorities as ordinary income upon vesting.

- The phantom shares plan forms part of your cap table and the vested phantom shares will dilute stakeholders when the company gets acquired or IPOes.

How are Phantom Shares Paid Out?

Phantom shares are usually paid out when the company gets acquired or IPOes. The phantom shares are paid out in cash for their corresponding value. In case of the acquisition, the acquirer must deduct from the total acquisition cost the money to be paid out to employees with phantom shares.

Upon getting acquired, shareholders will only get diluted by the amount of vested phantom shares, also taking into account potential acceleration rights. For example, if a company has a phantom share plan with 10k shares and at the time of the acquisition, only 5k shares have been granted and vested by employees, the rest of the shareholders will only get diluted by the 5k phantom shares which were vested already.

Companies may also buy back some phantom shares from employees at a discount if it was already established in the original contract. Buybacks are an effective way of giving employees liquidity and making space in the cap table without increasing dilution.

How to Create a Phantom Shares Plan?

From the company's point of view, launching an incentive program like a phantom shares plan is usually a task that becomes more complex as the number of investors and employees grows, but the process is usually the same:

1. Design of the phantom shares plan

The first step is for the management and founder team to align on the essential elements of the plan, for example:

- Size of the plan (pool size): defining the % of shares that you want to allocate is critical. The so-called pool size ranges from 5 to 15% of the total shares available. It is usually closed just before an investment round.

- Vesting period: the period over which the shares will be vested. Usually, the vesting period is 4 years.

- Vesting schedule: Simple structure is the most common (in case of 4 years of vesting, 25% of shares are vested each year). Still, it is possible to grant shares under a different schedule (20% in the first year, 25% in the second, 25% in the third, and 30% in the fourth). Phantom shares can be vested every month, quarterly, or annually.

- Cliff: minimum period an employee needs to work for to start having access to the vested phantom shares. For example, if an employee leaves after 11 months and the cliff is 1 year, no shares will be considered vested. However, when the cliff is reached, then all the ‘vested shares’ become available at that moment (1-year cliff = one year’s worth of phantom shares).

- Acceleration clauses: accelerated vesting in a phantom shares plan implies that the phantom shares will vest immediately if a specific event occurs. For example, there could be an acceleration clause within your phantom shares plan in case of an acquisition/IPO. In that case, the unvested shares would be accelerated, becoming the employee's property. There are different types of acceleration clauses:

- Full acceleration: when there is a trigger event, all the unvested shares are accelerated and fully vested.

- Partial acceleration: when there is a trigger event, a specified % of unvested phantom shares is accelerated.

- Single trigger, double trigger or x trigger acceleration: this clause specifies the number of conditions (triggers) that need to happen for any acceleration to occur.

- Liquidity event: a triggering event specified in the agreement for the execution of the phantom shares plan. Typical triggers are the moment when the company gets acquired or IPOes.

- Repurchase or buyback: the company may reserve the right to repurchase phantom shares early before the liquidity event, usually at a discount based on the market valuation. This clause is used mainly in successful companies. The primary motivation for such an activity is for investors to acquire more company shares without further diluting the founders.

- Definitions of good and bad leavers: the exit or abandonment clauses define what will happen to the phantom shares (assigned, vested and non-vested). These are determined based on the reason for the end of the employment relationship with the company. Usually, a good leaver covers death, retirement, illness, unfair dismissal and sometimes voluntary leave.

2. Approval of the plan

Once the compensation system is defined, the executive body (usually the council) approves the plan.

3. Launch of the plan

Sending the employee invitation letters, setting up meetings and organizing an information flow to explain the conditions will be a necessary step when launching your phantom shares plan. Communication strategy around employee equity compensation will have to play a big role to ensure the success of the plan.

4. The management of your phantom shares plan

First, your company's lawyers will create and prepare the documents. But once the plan is approved, somebody will have to manage the employee grant letters and vesting calculations, provide ownership visibility, send letters of consolidation when employees leave the company, and keep the phantom shares plan up to date. Capboard automates all these processes and provides the tools to set up the plan, manage it efficiently and give the much-needed visibility for every party involved. Learn more about how you can automate your company's compensation plans.

Advantages of Offering Phantom Shares to Employees

Offering a phantom stock plan to employees is an effective tool startups can use to reward loyalty and incentivize the workforce. It is a good alternative to an employee stock option plan (ESOP), and here is why.

- This type of incentive compensation program provides employees with a financial benefit based on the company's performance. As a result, it creates a mutually profitable dynamic. But, you don't have to give equity and dilute your stakeholders, which is the case when offering stock options.

- Awarding phantom shares does not require cash outflow right at the moment. That allows you to enjoy the positive impact of such a plan while your company is still developing or fundraising.

- It encourages worker engagement and performance. At the same time, it helps startups retain talented employees that have been integral in helping grow the company. A phantom stock plan can build loyalty within the staff and support rapid expansion. It is especially relevant as the company gains more ground in competitive markets.

- Phantom shares allow employers to align their long-term interests with their employees. It is done by setting up target vesting milestones. That means creating a performance-based compensation system using phantom shares. And such an approach can help you encourage employee performance over the long term.

- Cap table management is easier when having a phantom stock plan and not a stock options plan as phantom shares’ beneficiaries will never become shareholders. Hence, it has no impact on the company’s governance.

Disadvantages of Offering Phantom Shares to Employees

Offering phantom shares to employees can seem like a great idea for startup founders looking for a way to provide compensation. But it's essential to consider the potential drawbacks:

- Employees may not understand the implications of owning nonexistent shares. Something that can put the whole plan at risk of failing and harming the company and the team’s morale.

- Furthermore, real stock options may be more attractive forms of compensation due to their cost structure and increased liquidity.

- It's important to note that employees with phantom shares are not calling the shots. They cannot decide when they will receive the compensation. The phantom shares are redeemed when particular circumstances trigger them. For example, when the company is sold, is part of a merger or goes public. Such triggers need to be specified in the phantom shares agreement.

In the end, phantom shares are just that - phantom or virtual. That means they exist on paper only. No rights to equity are granted, so employees cannot buy any shares. However, employees can keep the vested phantom shares if they leave as good leavers.

Phantom shares vs RSUs vs SARs

Phantom shares, RSUs (Restricted Stock Units), and SARs (Stock Appreciation Rights) are popular methods of offering employee compensation in startups. The three plans share similarities. However, there are significant differences that founders should be aware of.

Phantom shares

- Phantom shares are a type of compensation where employees receive notional shares in the company.

- Unlike RSUs, they do not provide ownership rights.

- But they do entitle employees to economic benefits since their value is tied to the company's share value.

RSUs (Restricted Stock Units)

- RSUs give employees a certain number of shares in the company, which they can sell once they vest.

- Once the shares have vested, employees may choose not to sell them at the market price and keep them for potential future profits.

SARs (Stock Appreciation Rights)

- SARs give employees the right to receive an amount equal to the increase in the value of a set number of shares without owning them.

- It means that employees do not have to buy any shares. Instead, they receive a payout equal to the increase in the value of the shares.

- However, they can choose to get the shares for the value of the appreciation.

Employers must be aware of the various tax consequences of each compensation strategy. It is also crucial to remember that each compensation has specific rules and regulations. It is recommended to seek advice from legal and financial professionals before deciding on a compensation strategy.

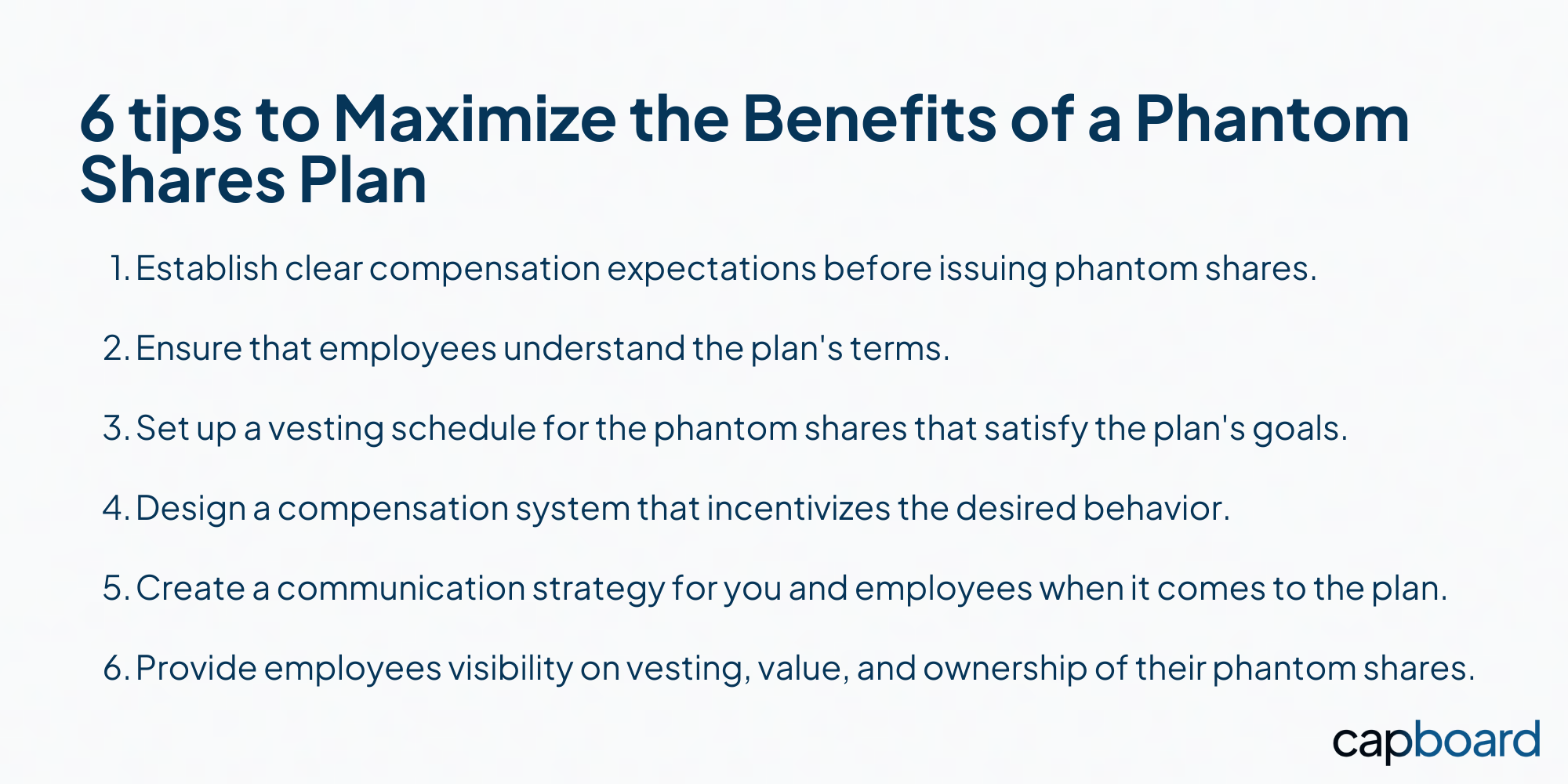

Tips for Maximizing the Benefits of Offering Phantom Shares

Phantom shares incentivize employees to stay for the long term and perform. They can also provide tangible returns on their hard work. With a well-crafted phantom stock plan, employee compensation can increase significantly. That makes it a win-win situation as the employees and your company benefit from such an arrangement! It's important to make key employees a part of the decision-making. It will allow for maximizing the benefits for both parties. Employee input plays a crucial role in developing an agreement that works for everyone. Here are 6 steps for maximizing the benefits of offering phantom shares.

Offer Phantom Shares at Your Startup with Capboard

Offering phantom shares can be an effective way to inspire employees and create a long-term, results-oriented culture within your startup. Considering the legal and organizational implications of such a plan is crucial before introducing it in your organization. But when done right, you and your team can be greatly rewarded.

Phantom Share Vesting Employee view: