A SAFE is an agreement to provide an investor with shares of the company when a trigger event occurs. There are two main types of SAFE: pre-money and post-money, and the main difference is the point of time when they convert.

Creating SAFEs on Capboard

The first step to model how your SAFEs will convert at different valuations is to add them on Capboard. It is very easy:

- Create an account

- Add your company incorporation

- Add your SAFEs from Ownership > Transactions > Add Transaction > Convertible note. Add all the details: Valuation cap, discount...

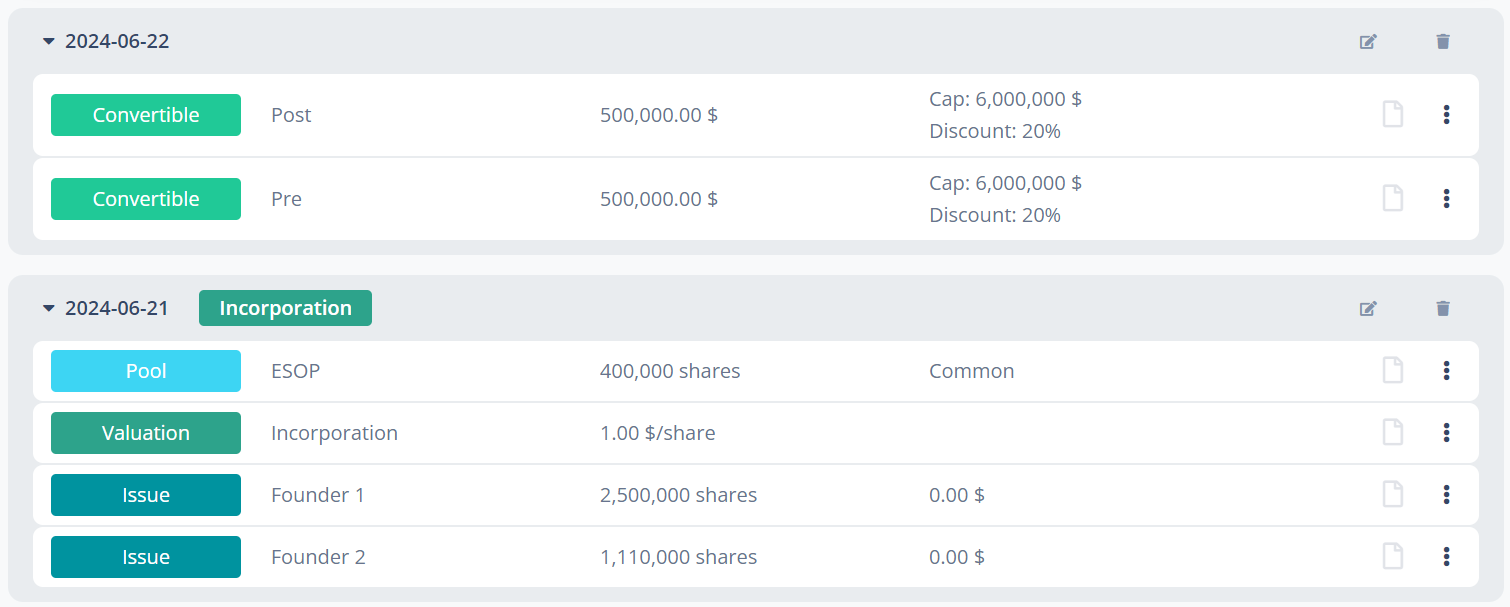

Once done, you should see something like this. In this example, we have a startup with 2 founders that have raised 2 SAFE of $500k each at a $6m valuation or 20% discount.

Modeling SAFE conversion

"Simulations" is the Capboard feature that allow company founders to model as many scenarios as needed in an easy and private way. Upon creation, the simulation automatically imports the current cap table, including all unconverted SAFEs.

To model how SAFE would convert, follow the steps:

- Go to Ownership > Simulations and Create your first simulation.

- Post-money SAFE usually convert with a priced funding round, so let's pick "Funding round".

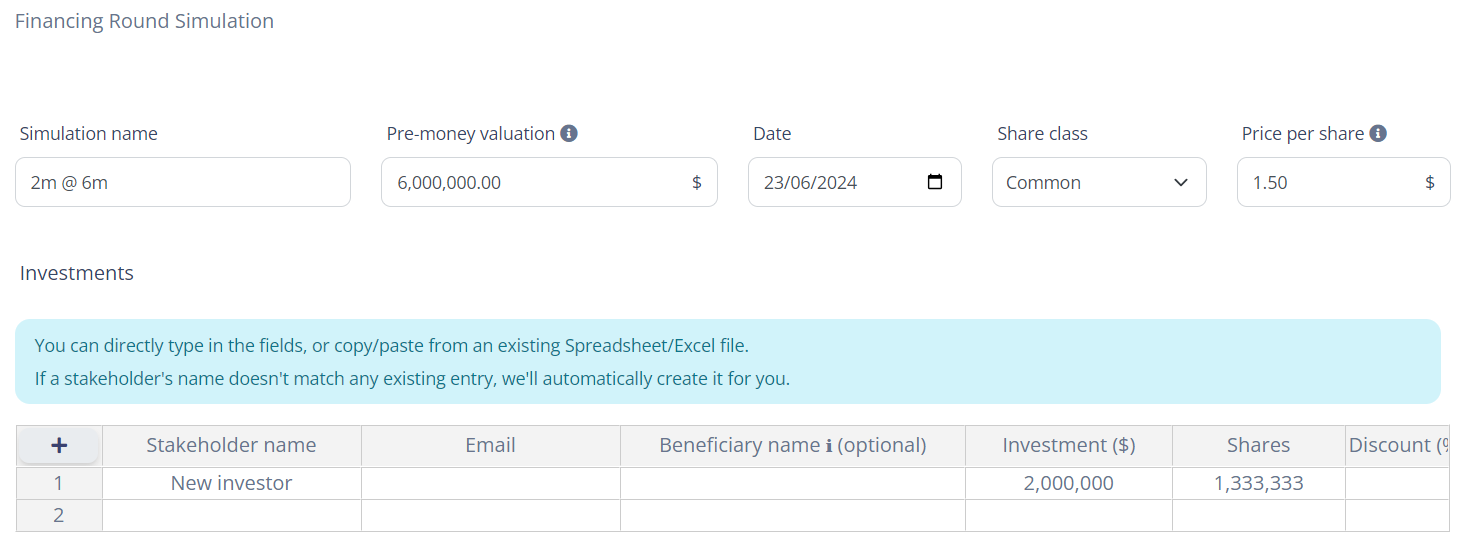

- Fill the funding round details: date, pre-money valuation, and the investor details and the amount they will invest.

- Click on "Generate cap table" and check the results of the funding round without the SAFE. If you are satisfied, click on "Save simulation".

- Now we see the cap table, but let's proceed to model the SAFE conversion. Click on "Transactions" on the left hand menu, just below "Simulations".

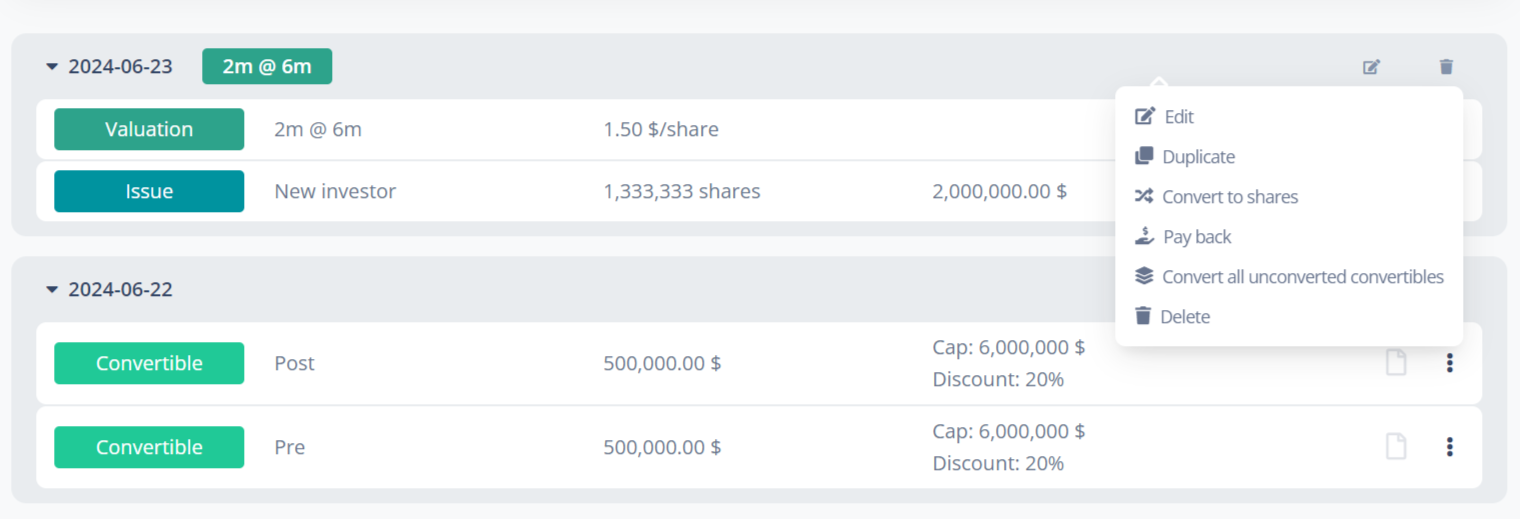

- We'll find the simulated funding round and the unconverted SAFEs. We can choose to convert them one by one (Convert to shares) or at once (Convert all unconverted convertibles). Click on the three dots next to a Convertible and choose the option you prefer.

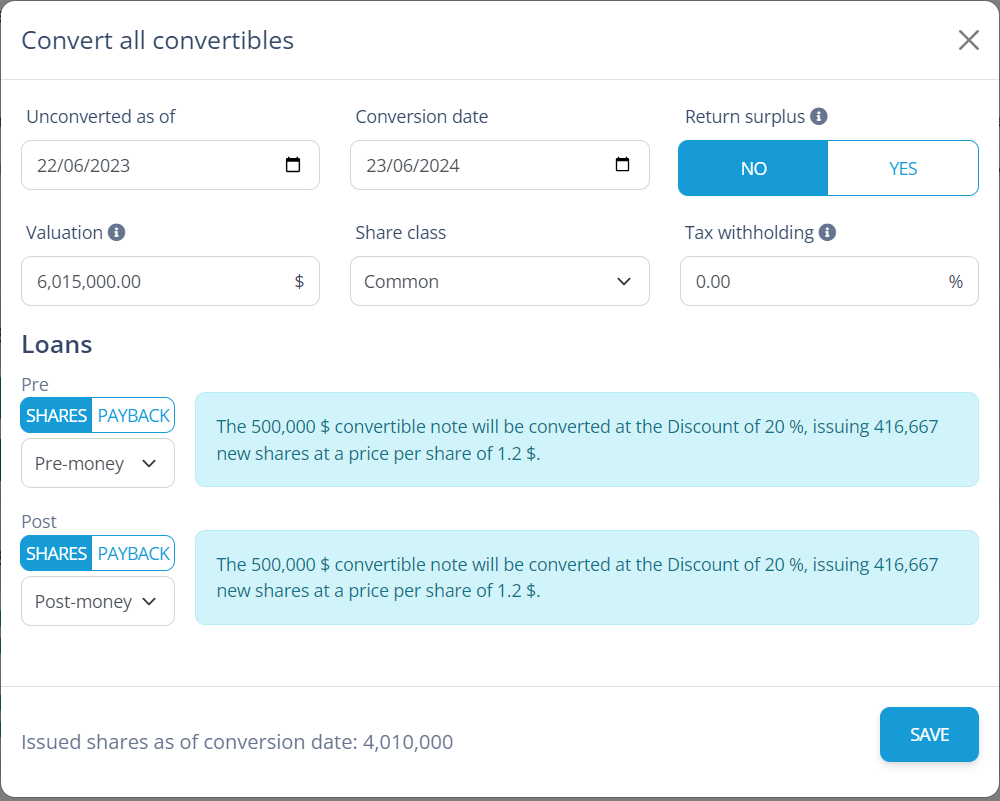

- Let's set up the SAFE conversion: pick the conversion date (Important: it has to match the priced funding round date), pick which SAFEs were pre/post-money and check the conversion results in the blue box. If you are happy with the result, click Save.

- Following our example, these would be the conversion details converting at a 6m valuation. As the 20% discount would be more favourable to investors, the Cap would apply and both SAFE would convert to the same amount of shares.

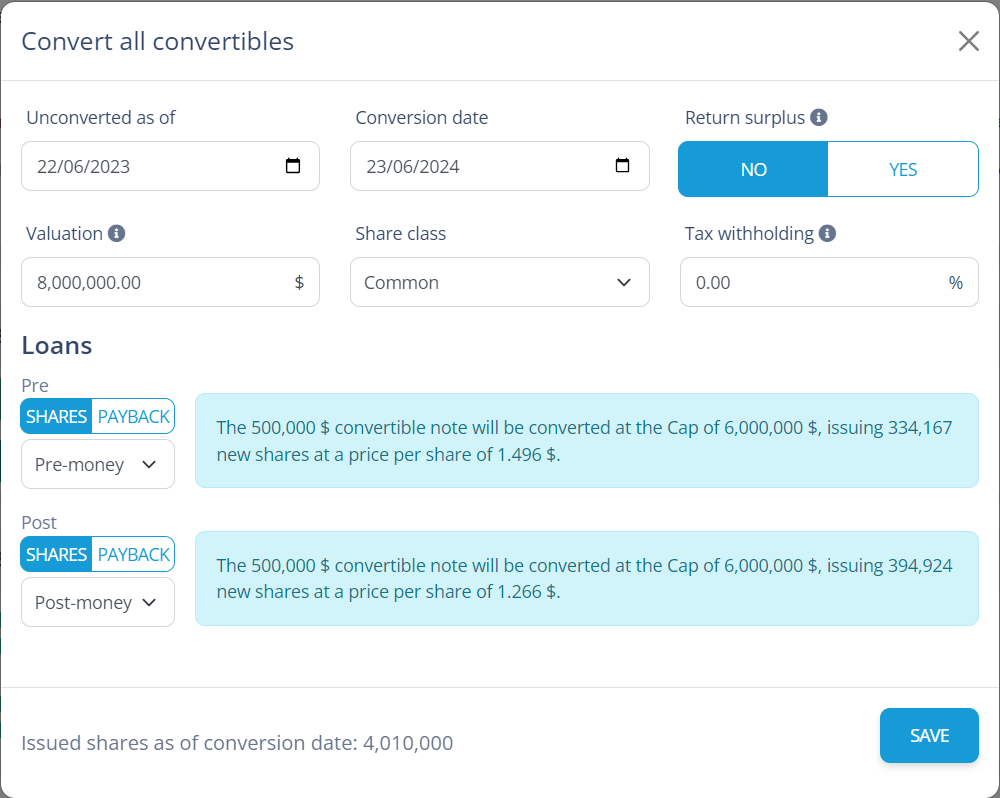

- On the other hand, let's check what would have happened if we were to raise at a $8m valuation: the Pre-money investor would be worse off than the Post-money investor:

- Following our example, these would be the conversion details converting at a 6m valuation. As the 20% discount would be more favourable to investors, the Cap would apply and both SAFE would convert to the same amount of shares.

- Voilà! Now we can go back to the Cap table and see the final result at a 6m valuation:

- Simulations are private, but you can download each of them to Excel, PDF or even share it with other Capboard users.

You can use Capboard to model the conversion of your SAFEs, keep your shareholders up to date, generate share certificates and manage your ESOP. Start for free without speaking to sales!