One of the main goals of every startup founder is to organize the best team for a company's mission. And getting experienced advisors on board can be a great decision.

But when cash is limited, you may want to consider using other types of compensation. Advisory shares can be an excellent tool to reward these experienced and knowledgeable individuals who can provide valuable guidance and mentorship.

So let's discuss what advisory shares are, how they work and everything you may need to consider when getting advisors to join your company.

What are Advisory Shares?

Advisory shares are a type of equity compensation that companies use to incentivize advisors. In exchange, advisors are expected to provide guidance, services and support to the company. Equity compensation aligns the interests of advisors with the company. It also creates a sense of ownership and commitment.

By rewarding advisors with equity, their monetary benefit will depend on the company's performance. And that is why advisory shares are growing in popularity, especially among early-stage startups.

How do Advisory Shares Work?

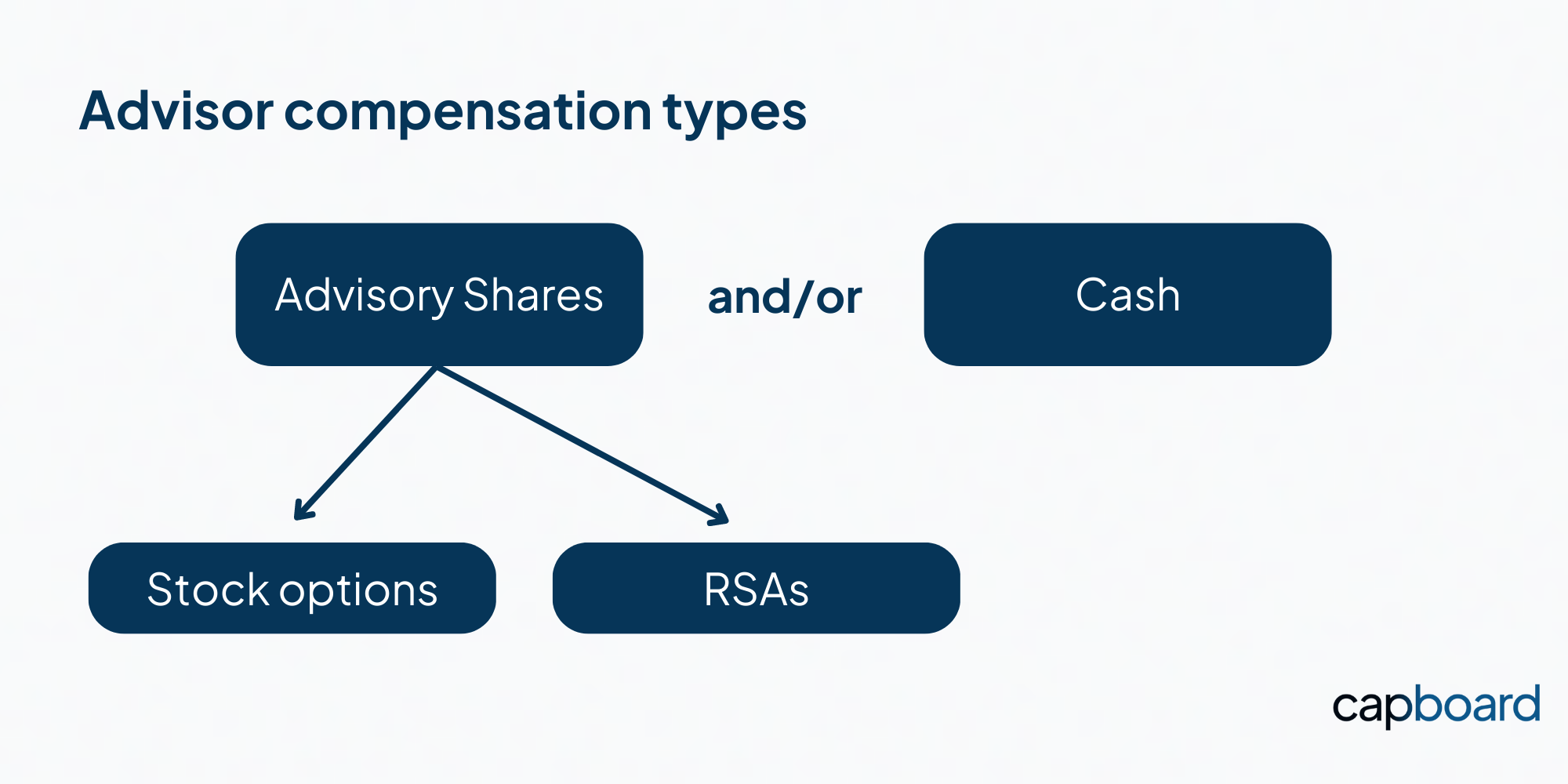

Advisory shares can be issued to advisors using different types of assets. Stock options and restricted stock are the primary tools startups use to compensate advisors for their services. In some cases, cash contributions are also a part of the compensation.

Stock Options for Advisors

Stock options can be used to compensate advisors as a part of the startup-advisor relationship. These work similarly to how you would normally compensate employees with stock options as a part of the ESOP (Employee Stock Option Plan). They give the receiver the right but not the obligation to acquire company shares for the pre-specified strike (exercise) price.

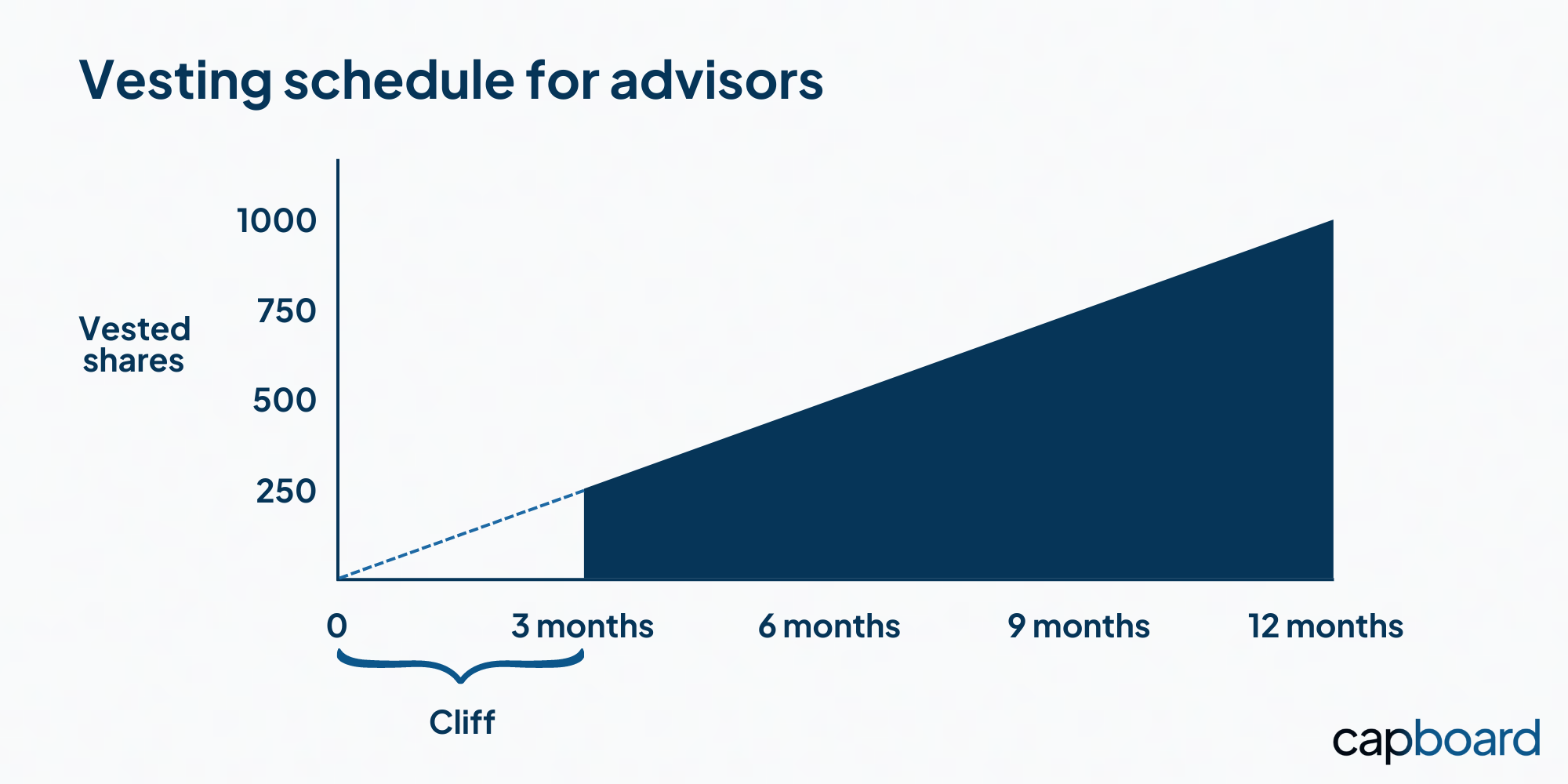

It is important to note that advisors are expected to have a more leveraged input than employees. And as a result, advisors provide a faster ROI compared to employees. Therefore, an advisor-company agreement typically has a vesting schedule of 1-2 years with either no cliff or a short one of 3 months. In comparison, it is a common practice to have an ESOP vesting schedule of 4 years with a 1-year cliff.

Restricted Stock for Advisors

Restricted stock awards (RSAs) are a type of stock grant the recipient can pay for with either cash or services they provide to the company. Once the RSAs are granted and necessary purchase requirements are met, the grants have to vest for the recipient to become the stock owner. The vesting can be time-based, milestone-based or a combination of the two.

For some advisors, RSAs are a more desirable option than stock options. RSAs can be structured to require a lower (or no) cash payment. There are cases when an advisor does not have the necessary funds to exercise the stock options. Then the company can instead grant an RSA for their services and solve the problem.

It is crucial to consider any tax implications associated with advisory shares (whether stock options or RSAs). We advise you to consult a tax professional to understand the tax implications of granting advisory shares. That will ensure compliance with all applicable tax laws and any legal considerations for advisory shares.

Equity vs Advisory Shares

Advisory shares are a form of equity compensation provided to advisors specifically. Other types of stakeholders cannot receive these shares. These shares serve the purpose of compensating advisors under the advisory shares agreement. When the company decides to use stock options under such an agreement, it may be recognised as an ESOP for advisors. But the purpose and the conditions behind an advisory shares plan differ from what employees typically have with the ESOP.

Why Use Advisory Shares?

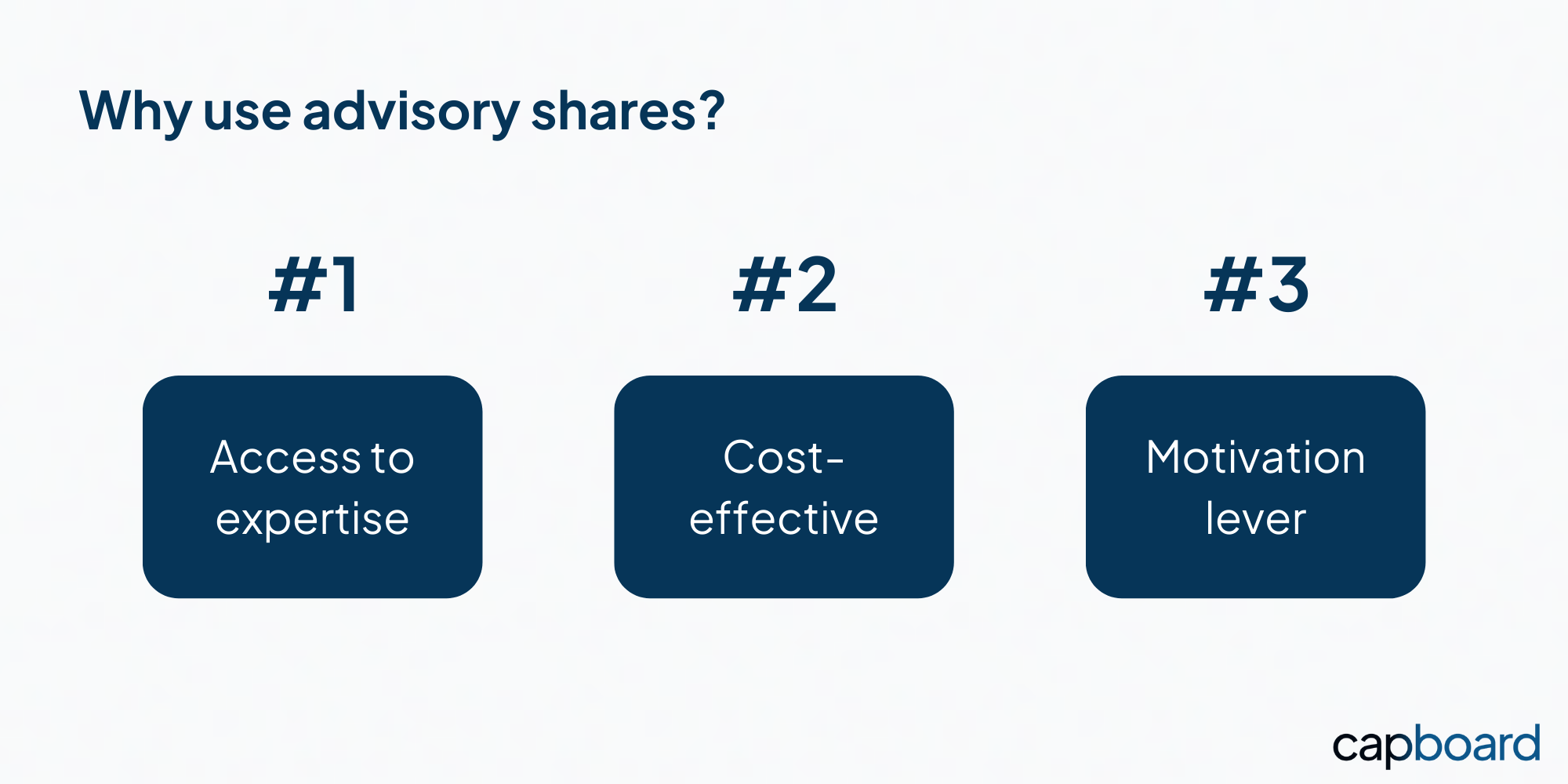

There are several reasons why startups might choose to use advisory shares. Here are the main benefits of advisory shares for startups:

- Access to expertise: Advisors can provide valuable guidance and mentorship to startup founders. By offering advisory shares, startups can attract experienced and knowledgeable advisors who might not otherwise be interested in working with a young company.

- Cost-effective: Compared to hiring a full-time executive or consultant, advisory shares can be a more cost-effective way to get high-quality advice and support. Since advisors don't receive a salary or benefits, startups can save cash while still getting the needed expertise.

- Motivation lever: By offering a stake in the company's success, advisory shares can motivate advisors to work harder and be more invested in the company's growth. It can be especially relevant for companies at an early stage, fighting for survival.

How to Use Advisory Shares Effectively?

To use advisory shares effectively, startups need to be strategic about who they bring on as advisors and how they structure the advisory shares agreement. Here are some tips for using advisory shares effectively:

- Be selective: Not all advisors are created equal. To get the most value out of advisory shares, founders need to be selective about the advisors they bring on. Having a list of advisor qualifications can provide guidance when it comes to choosing who will receive advisory shares. Seek advisors who are experienced, knowledgeable in the area you need help with, and have a track record in the industry. Sometimes, you may consider bringing on an advisor with a network you want to enter.

- Set clear expectations: Before granting advisory shares, startups should set clear expectations for the relationship. Crucially, this should include the advisor's responsibilities. Then, there is the expected time commitment, the vesting schedule, and other agreement terms.

- Establish metrics for success: To ensure that advisors provide value to the company, establishing metrics for advisor success is vital. It could include milestones related to product development, revenue growth, or customer acquisition. By setting clear goals, startups can hold advisors accountable and ensure they provide value.

What are the Key Elements of a Startup Advisor Agreement?

Structuring advisory shares agreements for success takes time and involves the negotiation process. You can find a FAST (Founder / Advisor Standard Template) agreement to download here. Here are the key elements a startup founder cannot miss when creating a startup-advisor agreement:

- Roles and responsibilities: defining the expectations in the written agreement adds a legal foundation to the relationship. Making sure you take the guesswork out of this startup-advisor partnership will provide the necessary structure. Specify what areas of focus an advisor will provide guidance on, the kind of services that will be given, the way these will be delivered and the time commitments expected will go into this agreement.

- Compensation type: clearly defining the compensation that will be given in exchange for the services mentioned above and the specific amount. As presented already, it can involve stock options, RSAs, other types of equity assets, and sometimes cash payments.

- Vesting schedule and other equity compensation-related terms: The advisory shares will typically be subject to a vesting schedule, which means they become fully earned over time or upon meeting specific milestones. Suppose an advisor leaves the company before their advisory shares fully vest. In that case, they will typically only be entitled to the already vested shares. But these terms are subject to negotiations. In addition, the details under which stock options/RSAs can be received and any implications of such transactions.

- Non-disclosure and confidentiality: including the sections that legally protect you and your company’s sensitive information is essential, as advisors will have access to such during the relationship period.

What is a Good Percentage of Advisory Shares?

The advisor's equity stake will depend on several factors, including their experience, the time they will commit to the company, and the expected value of their contributions. It's essential to be strategic and consider these factors when determining the percentage of the equity to grant. A typical range is between 0.1% to 0.25% of the company equity.

However, use common judgment to determine fair compensation for your advisors. Those who can provide crucial input, solve a painful problem, and make valuable introductions can be compensated more significantly. In some cases, equity compensation can reach 1% of the company.

Finally, as a note of caution: giving equity to advisors can be a double-edged sword. That means there are drawbacks to take into account. It includes having a more complex cap table, dilution and raised questions from potential investors during the due diligence.

Startup Advisory Board

Building a powerful advisory team can be just as crucial for a company founder as hiring quality workers. As mentioned earlier, being selective is crucial. These individuals will have to support your vision, company, team, and other fellow advisors to bring results.

Creating a company advisory board is something you can consider. This board can consist of individuals who bring a range of skills and experiences to the table. These advisors can provide feedback and guidance on everything from product development and market strategy to fundraising and hiring.

What’s important to keep in mind is that having many advisors can add complexity to your cap table. As your company grows, some advisors become less relevant than others. An advisor who helped you find a product-market fit at the seed stage may not provide a valuable contribution when trying to raise a Series A round.

Main Disadvantages of Issuing Advisory Shares

Issuing advisory shares has a few disadvantages that must be considered before you begin using equity compensation. Advisory shares are a double-edged sword: you give way a precious resource - your company’s equity - to more individuals. Here is why it may be a problem:

Advisory shares in your cap table

Giving advisory shares can raise questions for potential investors. Imagine a scenario where you are excited to raise a new round. You build your investor pipeline, and it’s time for potential investors to review your cap table. When doing so, they see different shareholders without any invested capital and begin asking questions: “Who are these guys, and why do they have this amount of equity?”

That is when you will need to make sure you can explain the inputs of these advisors with equity in your company. And to do that, your advisors must be great: relevant to your stage, experienced, knowledgeable and valuable. If that is not the case, it may push potential investors away. Why? One of the reasons is dilution!

Advisory Shares and Dilution

One of the drawbacks of issuing advisory shares is that they dilute existing shareholders. The impact of having a new advisor on your cap table may not be significant when you are early on. But when your company’s valuation makes a small percentage of equity a valuable piece, dilution will be felt by all affected shareholders.

Keeping the finger on the pulse regarding the dilution of equity through new issuance is crucial. One thing you can do is simulate transactions and perform scenario modelling. It can help you have visibility over the equity to ensure dilution does not catch you off guard (it can be a very costly surprise).

As your company grows and cash becomes a more accessible resource compared to your company’s early stages, you may start compensating advisors using it. By restructuring your advisor compensations in that way, you will be able to reduce the dilution. Less advisory shares will be issued as advisor compensations will be more cash-focused.

Issuing advisory shares with Capboard

Having experienced advisors on board and compensating them fairly using advisory shares are two things you can do to help your startup increase its chances of success. We know how overwhelming the life of a founder can get. That is why, with Capboard, you can automate the process of issuing advisory shares and focus on what truly matters - building your business!